For better or worse, the gender pay gap (currently at $0.77 per dollar) is now a fact of life we all seem to accept, sadly, as each equal pay day for different gender and racial demographics passes throughout the year. Given that our paychecks are not only necessary to our survival day-to-day, but also to our personal sense of worth in a culture that so heavily values money, it’s appropriate that equal pay day be noticed and recognized. However, the perpetual focus on pay inequity masks a deeper and more meaningful issue, the gender wealth gap, to which the pay gap contributes.

Wealth is typically measured in two ways:

- Financial cushion, available to address unexpected costs (e.g., medical bills, family emergencies, disability, extended retirement etc.)

- Discretionary funds available for non-essential spending and investment

Women bear the burdens of greater financial pressure than men

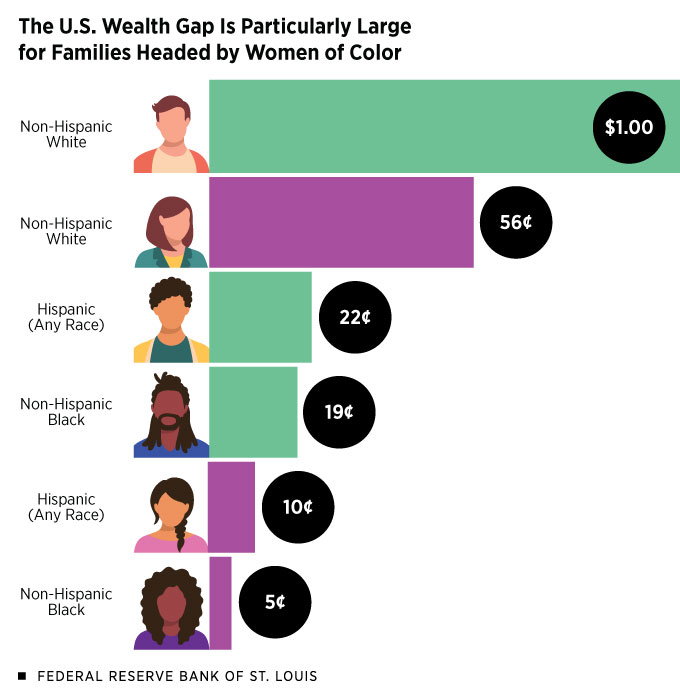

It turns out that, women’s wealth is generally from $0.34 to $0.96 to one dollar for a man in the U.S., depending on how it’s calculated, and about $0.74 globally.

And while a pay gap affects individual women and people of color primarily, the wealth gap is both more cumulative and socially entrenched than the pay gap. Reasons behind the wealth gap include the cumulative, lifetime effects of at least these factors:

- The gender and racial pay gap

- Career gaps and time out of the workforce for caregiving

- More time spent while they’re working on family matters

- Higher debt and higher interest rates

- Higher costs on women’s products (aka, the Pink Tax)

- Lower investment rates for the cash they have, leading to lower retirement savings

- Higher spending on families

- Lower job resilience in the case of disaster

Exacerbating these dilemmas are the factors creating worklife inequities within families and communities.

Who pays what cost?

The cost to this reduced wealth and income is not just borne by women. Men and children, especially those in female breadwinner families, suffer. Society at large pays a financial cost as well in the form of a lower GDP that cannot reflect the full earning potential of all its citizens across both racial and gender dimensions. For example, California could claim an additional $460B a year in GDP, growing by almost 50% if it fully realized the earnings potential of its people.

But let’s not forget that wealth is not really all about the money.

Quality of life, and the ability to experience qualitative richness throughout your life is of course a factor. While it’s hard to put price tags on the joy of spending time with children, taking a luxurious vacation or taking time to reflect and rejuvenate, these things do matter. Anecdotal evidence points to the fact that women take a more holistic approach to thinking about lifetime wealth, leaving them in a different headspace and heartspace when it comes to planning for, and living in retirement. Specifically, women are more likely to work longer, for both financial and worklife quality reasons. In some cases they choose to, and in many cases they have no choice.

When it comes down to it, “wealth” really means many things, and different things to many people. So although there is clearly a financial gender wealth gap, the solution may or may not look like complete equality for many individuals and families.

Photo by Ashim D’Silva

An InPowered way to consider the gender wealth gap

When we look at national and global statistics like this, this kind of analysis can be inherently disempowering. After all, there are so many variables here that we as mere individual humans do not control. What is an individual to do?

Well, I will admit I’m coming at this question from a personal deficit of knowledge. Despite thinking I understood wealth planning at least at a cursory level, this research has made me question many decisions I’ve made over time and given me some new things to think about.

Because financial issues are so inherently personal, there’s no true solution that fits all. However, getting smarter will help you manage your own situation much more effectively. Also, working with professional advisors who can guide you to understand how some of the gender and demographically related trends might be impacting you, and the true options you should consider, is also a good idea. Here are a few practical steps you can take:

- Read the links on this article for a better understanding of the trends and how you may/may not fit into them

- Follow some female-focused financial information resources, like Ellevest

- Map out a couple of scenarios for your life, given what you know about the possible timing of children, elder care, need for personal breaks without income, goals, retirement etc. (Having a map is not a promise that this will be your future but it can be a planning framework.)

- Talk to your partner and close family members who are affected by your financial decisions and collaborate on these scenarios

- Give the scenarios to a financial advisor who will work with you on the intricacies of it, particularly those that don’t fit the “work 40 years and retire” scenario.

- Adjust your plan every year or two

On its face, these items don’t seem that daunting, but actually they are. There really is no formula for doing it right. The most important thing is to be sure to go into this with your eyes open on the trends. It may change some of your planning and scenario assumptions.

The emotional aspects of money for women

I’ve been considering why this is such a difficult issue for so many people, women and men alike, and why women seem to struggle more as a group to build wealth systematically. I know there are books and seminars galore on this, but I think it’s worth reflecting briefly on the way that money and wealth relate to our personal power.

Money in all its forms is one of the purest distillations of power we have in our society. Further, in developed capitalist-based economies, the power of money has been taken to its extreme, elevating wealth to become a proxy for almost all forms of power.

Women, and racial minorities generally, have been historically so systematically separated from all forms of social power—especially money where women have only had the legal right to control their own money for about 50 years—that it’s no surprise that we don’t have a culturally-supported and sophisticated relationship with financial power.

And as much as I’d like for inner, personal power to be more important than social and economic power (since personal power is available to everyone, for free), it simply isn’t for most of us. Unless you triangulate your definition of success within a community of people who collectively value other things over money, or eschew community status altogether, there is just no escaping the fact that you will be judged, and judge yourself, based to some extent on your apparent wealth. To some extent your self-esteem will be tied to it. To some extent, your wealth will be a factor in how secure and powerful you feel in the world, and how successful you feel yourself to be.

For these reasons, it’s worth taking responsibility for whatever wealth you have. Be honest with yourself about what you have, what you need and how to manage them both. Take on the hard conversations with others to try to plan in alignment with them. Get educated and make the best decisions you can.

And, beware that just like crises of confidence on any topic, the elusive “it’s never enough,” mindset will haunt you. I believe this is true even for people many would consider “very wealthy.”

In a true sense, no amount of money (or influence, or credibility or success….) is enough. This is because when it comes to power, security and managing risks, fear and uncertainty are always right around the corner, as is the next disaster no one can predict.

Luckily for those of us on the INpower journey, fear and uncertainty ARE the inner, personal power game. So I think the lesson here is to play both the inner and outer games of power simultaneously. You need both, financial resources and a personal sense of non-financially based power to find any form of success that will sustain you.

I know I’m going to be thinking about the topic of wealth a little differently now that I’ve pieced all this together. I hope you will too! And please share with other women in your life who can benefit.

Join Our Women’s Mastermind

Mar 19 – Is the era of “good leadership” over?

Apr 16 – Psychological Safety and Gendered Competition

May 16 – TBD by the group